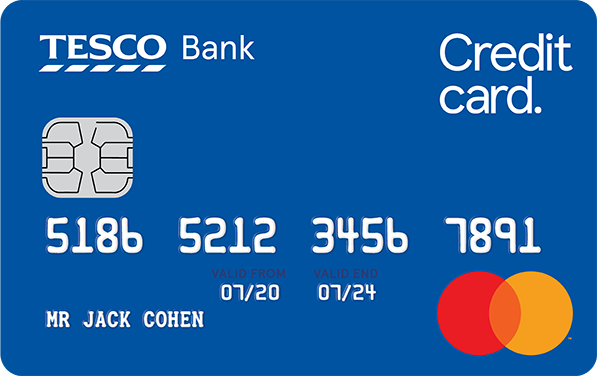

The Tesco Bank Low APR credit card is an absolute gem in the realm of credit cards in England!

- A low 10.9% APR representative.

- Collect Clubcard points.

- Our Credit Card jargon buster.

If you’re on the lookout for a credit option with low-interest rates, this card could be the perfect solution for your financial needs. Tesco Bank, known for its strong presence in retail, also offers highly competitive financial products, and the Low APR card stands out among them.

What makes this card so attractive is its extremely competitive Annual Percentage Rate (APR). This means that when using it, the interest costs can be significantly lower compared to other cards available on the market. It’s ideal for those looking to make purchases or transfer balances from other cards without worrying about high interest rates accumulating quickly.

Furthermore, Tesco Bank often includes additional benefits, such as loyalty points that can be accumulated and exchanged for discounts on Tesco purchases, adding exceptional value to everyday use of the card. You might be earning points for every pound spent, which is a fantastic way to save money on your regular expenses.

And it doesn’t stop there! The Tesco Bank Low APR credit card usually comes with introductory offers, such as zero-interest rates on purchases or balance transfers, making it even more appealing for new customers. These offers allow for more effective financial management and even greater savings in the long run.

Applying for the card is streamlined and can be done online, providing a smooth and convenient user experience. Tesco Bank strives to make the approval process quick and efficient, meaning you can gain access to your new credit card and start enjoying its benefits in no time.